Does paying interest on reserves stall growth?

byIn an interesting (pun intended) post (Economist’s View: Interest on Reserves and Inflation) Mark Thoma says that the Fed’s paying banks interest on their reserves does not dampen investment, for two reasons, one on the supply side and one on the demand side. On the supply side of the market for loans, Thoma points out that 0.25% (the rate the Fed is paying on reserves) isn’t that high. On the demand side, Thoma says that businesses have a lot of cash on hand that they’re not using to invest, meaning the demand for loans isn’t really there. I want to take issue with the second point, because while large corporations may indeed have a lot of cash on hand, small businesses and households don’t. And they are the ones who are being denied access to credit.

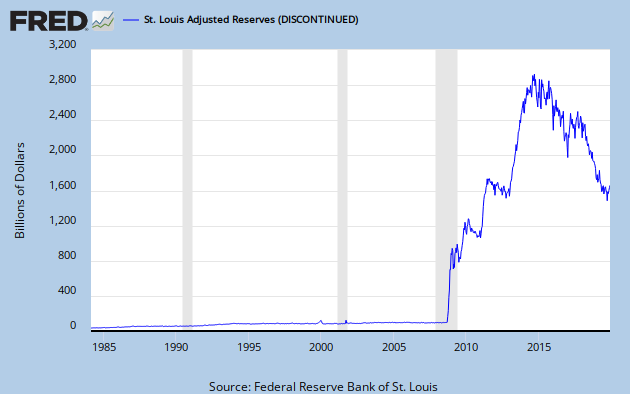

In an October report, the New York Fed found that many small businesses are being denied credit because of unrealistically stringent standards. An article in Newsweek suggest however, that standards are slowly being loosened for small business lending. On the household front, the National Association of Realtors (an admittedly interested [pun again intended] source), at their annual conference last week adopted a call on mortgage lenders to loosen their standards. While all this is not necessarily overwhelming evidence that banks are opting to collect interest on their reserves rather than making loans, I am nonetheless drawn back to charts like this one from the St. Louis Fed:

Banks are still sitting on a LOT of reserves that could be used to make loans.