Martin Wolf’s Liquidity Traps and Free Lunches Through Fiscal Expansion

byIn a good blog post for the Financial Times that did get money (mostly) right, Martin Wolf promised a Part II on the topic of appropriate monetary and fiscal policy in a “liquidity trap,” which he has provided here. Wolf also indicated he would write a piece on Modern Money Theory, an approach he does not address in either of these two articles. I look forward to that.

Meanwhile, let me say that I do not disagree with the substantive points made in his Part II—which examines an article by Brad DeLong and Larry Summers. The main argument is this: when there is substantial excess capacity and unemployed labor, fiscal expansion is a “free lunch”. There really should be no surprise about that—it was a major conclusion of J.M. Keynes’s 1936 General Theory, and indeed already had some respectability even before his book. Expansionary fiscal policy can put otherwise unemployed resources to work, so we can enjoy more output.

So what DeLong and Summers do is to show that given assumptions about the size of the government spending multiplier as well as a link between income growth and tax revenues (so that economic growth increases revenues from income taxes and sales taxes, for example) then it is entirely possible for a fiscal expansion to “pay for itself” in the sense that tax revenue will rise. If the “real” interest rate is low, then one can show that the “debt burden” of servicing additional government debt due to an increase of budget deficits does not rise. Hence “the fiscal expansion is self-financing.” (I have problems with all the terms in quotation marks, but will deal with only the first of these here, the notion that expansion can “pay for itself”.)

Let me skip to Wolf’s summary conclusion, with which I wholeheartedly agree: “Policy-makers have allowed a huge financial crisis to impose a permanent blight on economies, with devastating social effects. It makes one wonder why the Obama administration, in which prof Summers was an influential adviser, did not do more, or at least argue for more, as many outsiders argued. The private sector needs to deleverage. The government can help by holding up the economy. It should do so. People who reject free lunches are fools.”

Absolutely.

But….. well, you knew there had to be a catch.

Let me first deal with a complaint some of my fellow MMTers have made. They do not like the use of the phrase “free lunch” because in “real” terms the fiscal stimulus creates more jobs so that more of that “real stuff” can be produced. It isn’t a “free lunch” because someone had to do the cooking. OK, that is certainly true. However, to the extent that fiscal stimulus provides more jobs for the involuntarily unemployed, the extra work is desired and is socially beneficial in all sorts of ways that go beyond producing the extra lunches. Involuntarily unemployed are not voluntarily enjoying “leisure time” as orthodox economics argues—rather the time spent unemployed is stressful for the individual and for her family and friends, and unemployment generates lots of social costs. Most humans want activity, and especially enjoy roles as productive members of their social groups. Indeed, this is so obvious, I only need to explain it to economists who alone believe in this work/leisure dichotomy. I don’t.

That leads to the more important issue raised by MMTers, and it is one that I hope Wolf will address in his “Part III” devoted to MMT. Is it at all important for a fiscal stimulus to “pay for itself” by generating tax revenue to match spending (including interest payments)? And, more precisely, is there any sense in arguing that tax revenue “pays for” spending?

Let me say that I am not disputing the math of the simple models used by DeLong and Summers and reported by Wolf. I’ve long pointed out that increasing government spending in a fiscal expansion need not increase the current and prospective budget deficits for precisely the reasons they present. Deficits are not discretionary, they are outcomes that depend largely on economic performance. And Wolf certainly understands the sectoral balance approach of Wynne Godley—which demonstrates that there is a necessary, ex post, link among the balances of the government, domestic private, and foreign balances. All else equal, if fiscal expansion leads to sustained growth, the budget deficit will be smaller over coming years than it would have been without growth.

A fiscal expansion can very well affect both the domestic private balance and the foreign balance in such a manner that the government’s balance moves away from deficit and toward surplus (think Clinton years). But the relations are complex and will depend on country-specific circumstances. Still, we can understand that in the right conditions, a fiscal expansion “does not materially affect the overall long-run budget picture” (as DeLong and Summers put it) since current and future tax revenues rise to match current extra spending plus future interest payments on government debt.

(In the US, a successful fiscal expansion that generates growth will probably cause the private sector to want to spend more relative to its income, which causes its own balance to move to smaller surpluses while at the same time increasing imports that cause the current account balance to move toward larger deficits. If the leakage due to the current account deficit increases less than the fall of the leakage due to the private sector’s smaller savings, the government budget deficit can fall. Sorry, that is a bit complex—read it twice.)

Now in the case of a non sovereign government—say a New York State, or a Greece or Portugal, that is important. As a currency user (not issuer) New York really does use tax revenues plus borrowing to “pay for” its spending. If it could be shown that ramping up spending by the state government would generate growth and revenues to “pay for” the spending, then the state could stop down-sizing its labor force and other spending—and instead go on a much-needed spending spree. Otherwise, New York’s only hope is transfers from Washington to stop the downward spiral (see below)—but there’s no audacity of hope left in an Administration that is determined to cut its way back to prosperity. We are seeing similar behavior across Euroland, which has pinned its last hopes on the ECB. I won’t go into that can of worms here, but I’d put money on a born-again Washington before I’d bet on the ECB.

But a sovereign government like the US spends by “keystrokes”—it does not really need an increase in tax revenue in order to spend more. Indeed, in these models used by DeLong and Summers it is important to note that the increase to tax revenues is ex post, resulting if and only if the spending spurs growth. I’m not pointing out anything they do not understand, of course. I’m just repurposing their explication.

What if the revenue did not go up? Well, the spending would have occurred already, anyway—without being “paid for” by taxes. How was it paid for, then? By keystrokes—whether the tax revenue goes up or not, the spending is accomplished by keystrokes, crediting banks with reserves as the banks credit the deposit accounts of the recipients of the government’s largess.

What is the implication? Normally the Treasury sells bonds more-or-less equal to its deficit (I’ve explained the procedures over at the Modern Money Primer; begin with this one and read through Blog 24). And in normal times, these bonds are sold to private banks that use the reserves created by the government’s spending to purchase them. In abnormal times (now!) when the Fed is running QE1, QE2 and QE3, the banks then sell those bonds to the Fed and get stuck with low-earning reserves. So in normal times the Treasury pays interest to the private banks; in abnormal times the Treasury pays interest to the Fed, which pays lower interest on reserves to the banks. (The Fed then turns most of its profits back to the Treasury—so it is as if the Treasury did not pay that interest in the first place.)

How do the Treasury and Fed make these payments? Keystrokes, as Chairman Bernanke has patiently explained. Can they run out? Not so long as we can find any electrons to push through fiber optic cables in order to make electronic entries in balance sheets. I don’t think we’re running out any time soon.

To sum up. What am I complaining about? Well, not much. A clarification.

All government spending “pays for itself” in the sense that the payment through keystrokes is made simultaneously with the spending. If we need more spending, just do it. If a deficit results, so be it. If bonds are sold that entail future interest payments, stroke the keys to credit accounts. If you don’t want to pay the interest on bonds held by banks and others in the private sector, don’t sell them—or have the Fed buy them and pay the interest to the Fed, which then turns profits over to the Treasury. (We Want Our QE! QE Now! QE Forever!)

The problem, of course, is politically-imposed constraints: debt limits, deficit ratios, and the budgeting process itself. To be sure, that is a difficult problem. I suspect that will be Wolf’s main beef with MMT.

Finally there is one other complaint. Wolf argues that in the scenario posed by DeLong and Summers investors don’t need to worry about the long-run budget posture (since the spending “pays for itself”). But investors don’t need to worry about the budget posture in any case. A sovereign country that issues its own floating currency (the US, Japan, and the UK, for example) cannot go insolvent in its own currency; it can always make all payments as they come due (aside from those politically imposed constraints—that could lead to a voluntary default, which I think is a low probability default even if Republicans take over the government in the next election).

This is why credit downgrades of such nations do not “materially” impact interest rates on government debt. So it is not just in the “liquidity trap” that investors should not worry about budgetary outcomes.

What should they worry about? Inflation. And, yes, too much government spending can cause inflation. But that is true regardless of the budgetary outcome—indeed, for the reasons discussed by Wolf, rapid growth will probably reduce the budget deficit while generating inflation pressures! So looking at the budgetary outcome is misguided both inside and outside the liquidity trap.

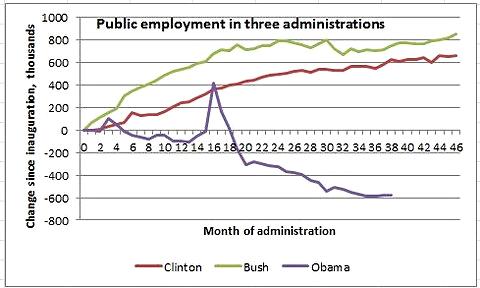

Let me finish with what should be seen as a scary picture, courtesy of Paul Krugman. If we look at total government employment over the current and previous presidential administrations we see that President Obama’s has seen an unprecedented destruction of public sector jobs. If I were President Obama, I’d be worried about the campaign slogan that he’s sure to be stuck with: “Obama the job destroyer.” No wonder we’re still in the doldrums.