Should the Dollar Remain Independent of Gold?

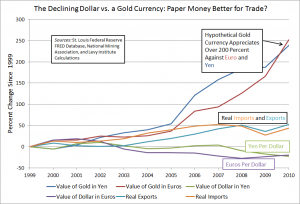

bySome “gold bugs” advocate a return to the gold standard, which the United States officially abandoned in the early 1970s. The annual data in the chart above show that the price of gold has risen sharply in both euros and yen since 1999. Meanwhile, the dollar itself has fallen against both of the currencies, as shown by the lines near the bottom of the chart. Easy monetary policy has played a role in this drop. But a weakening currency has been one factor behind the recent increase in U.S. exports. The latter grew more than imports in percentage terms over the period shown in the figure. But nonetheless, both imports and exports grew by over 40 percent. It would have been difficult to increase exports at all with U.S. goods and services priced in a surging gold-backed currency.

It goes without saying that the price of gold could possibly fall rather than rise in coming years. But dealing with a commodity money whose value can abruptly change in ways that harm the economy is always a severe drawback of a currency backed by gold. Of course, if the United States had adopted a gold-backed currency in 1999, U.S. wages, prices, etc. would likely have behaved much differently than they did. Hence, one cannot be sure what the outcome of a switch to the gold standard would have been. But these other changes could also easily have been detrimental to the health of the U.S. and world economies.

Comments follow: