The Boy Who Cried Wolf About Government Debt

In a New York Times editorial, David Leonhardt recounts Aesop’s apocryphal story about the boy and the wolf, warning that while deficit hawks have so far been wrong, the growing government debt will eventually bite. He reports the economic plans of both presidential candidates would add to the debt that will soon exceed GDP and grow to 130 percent of annual output under a President Harris, or 140 percent with a Trump presidency.

He rightly points his finger at high interest payments on the outstanding debt—that already exceed spending on Medicare—as a major cause of the rising debt. He concludes by arguing that austerity is the only long-term solution, targeting Social Security and Medicare to bear the brunt of budget cuts, along with tax increases to rein in deficits.

Leonhardt dismisses what he claims to be MMT’s solution—“that the Treasury can simply print enough money to repay the debt”—because it would cause inflation.

The story of the boy and the wolf was a fable, although it was within the realm of possibility. The fable of the debt wolf is not. It is interesting that Leonhardt is not able to point to any downside of budget deficits except that the debt is growing faster than GDP. But it has been doing that since the founding of the nation—as shown in Table 1, the growth rate of the federal debt ratio has averaged nearly 2 percent since 1789 (Tymoigne 2019). In the 2019–23 period, on average the debt-to-GDP ratio grew at a rate of 3 percent.

Table 1. Change in Gross Public Debt Relative to GDP, 1791–2023 |

|||

| Change in Debt/GDP Ratio Is | Average Size of Change in Gross Public Debt | ||

| Time Period | Positive | Negative | % of GDP |

| 1791–1930 | 66 | 74 | 0.31% |

| 1931–2023 | 86 | 7 | 4.16% |

| 1791–2023 | 152 | 81 | 1.85% |

| Sources: Treasury Direct, Bureau of Economic Analysis, Tymoigne (2019) | |||

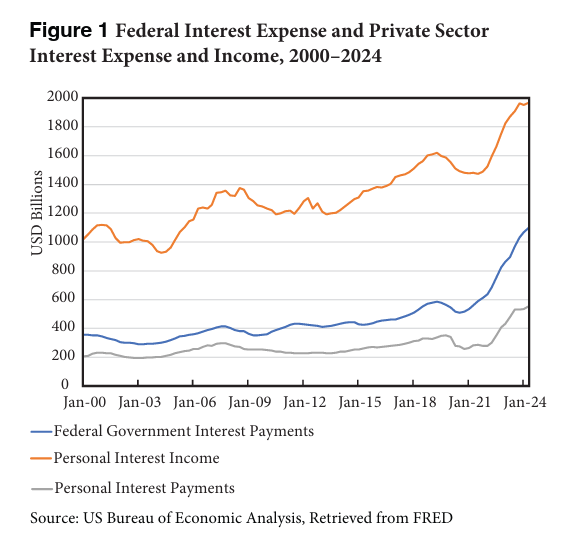

MMT points its finger at the Fed for high interest payments—and it is not just the Treasury that is spending more on interest as we can see in Figure 1, which shows personal interest income and private spending on interest quickly grew after Fed rate hikes, as did Treasury interest spending. While high interest payments by government do not threaten the solvency of the Treasury, they are inefficient (in terms of promoting growth and employment), can increase inequality (interest payments mostly go to the already rich), and can be inflationary (by boosting spending of those rich folk). High interest rates also hurt the private sector—by raising business costs (interest is a major business expense that must be covered by prices charged—potentially adding to inflation pressure) and by increasing payments on mortgages and consumer debt.

MMT does not say that the Treasury can print money to pay off the debt. The Treasury does not “print up money” to pay for any of its spending[i]—and there is no chance that it would do so to pay off the debt. The Fed is the Treasury’s bank and makes all its payments—just as your bank makes payments for you. The only difference is that there is a limit to how much of that the bank will do for you (e.g., your bank balance and credit limit). The Treasury’s limit is set by Congress by the budget it passes.

The Fed could, however, purchase all Treasury debt by issuing reserves—what is called “quantitative easing” (QE), adopted in the aftermath of the Global Financial Crisis. In that case, Treasury spending on interest would go to the Fed, which then returns excess earnings to the Treasury—offsetting Treasury’s interest expense. While Leonhardt claims that “printing money” would be inflationary, if the Fed bought all the debt (“print money”—in the form of reserves to replace it), that would remove interest payments from the economy, so it would be deflationary, not inflationary. While it is true that the Fed would continue to pay interest on the reserves swapped for bonds, it would only go to banks—at the base interest rate set by the Fed. The Fed can make that zero if it desires to do so.

Some MMT proponents do support elimination of government bonds—permanent and comprehensive QE policy—and they also support a policy of ZIRP (zero interest rate policy). This would eliminate interest payments by both the Treasury and Fed even as it eliminated the government debt as currently defined.

We do not need such a radical change to solve our debt “problem,” but need to instead promote a better understanding of government debt and interest rate policy. Government debt is not the big bad wolf. It is a safe asset that plays an important role in financial markets and portfolios of savers and retirees. Nor are deficits evidence of runaway fiscal largesse—it is the normal expected outcome for the US, as we will explain.

Leonhardt recognizes that what is considered to be an appropriate government debt ratio is rather arbitrary. The ratio, itself, measures the outstanding stock of government bonds (accumulated over the past 250 years) relative to the annual flow of spending. It reached 100 percent by the end of WWII and is nearing that threshold again. Does that ratio tell us anything important?

Many households have debt ratios far above 100 percent: a home mortgage of $400,000 with an annual income of $100,000 comes to a debt ratio of 400 percent. Scary? Possibly—but what matters is the ability to service debt out of the income flow, not the ratio itself. That will depend on other expenses and on the interest rate. Fed policy is the biggest factor determining the interest rate, and, hence, the monthly mortgage payment on a debt of $400,000.

Over the past few years, the Fed’s tight monetary policy significantly increased servicing costs—on both private and government debt. This contributed to the higher-than-average growth of the government’s outstanding debt. But the Fed has reversed course, and—barring a deep recession that would reduce federal tax revenues—that will slow growth of the government’s debt. Historically, robust expansions reduced the debt ratio by boosting tax revenues (that’s what happened after WWII) and by increasing the denominator, GDP; Fed rate hikes and the recessions that often follow them raise the debt ratio by increasing interest payments while lowering tax receipts.

The budget deficit and resulting debt ratio outcomes over future years will largely depend on economic performance and Fed behavior.

Remember when President Clinton announced that the federal government was finally running a budget surplus, and predicted it would continue to do so for 15 years, allowing the government to retire all its debt? He was cheered by deficit hawks and those with debt phobias. We at the Levy Institute said it would not happen. It did not happen, because the housing, commodities, and stock market bubbles burst, with the economy weighed down by Clinton surpluses that morphed into renewed deficits.

Projections of Trump or Harris administration debt ratios will also likely prove false—although we expect that the debt ratio will continue its slow, secular, 250 year and counting, rise. This is because good economic performance in the US requires that the government generally spend more into the economy than it pulls out through taxes, allowing the domestic private sector to save safe government bonds (and to import more than it exports to the rest of the world—points well-established by Levy’s sectoral-balance approach).

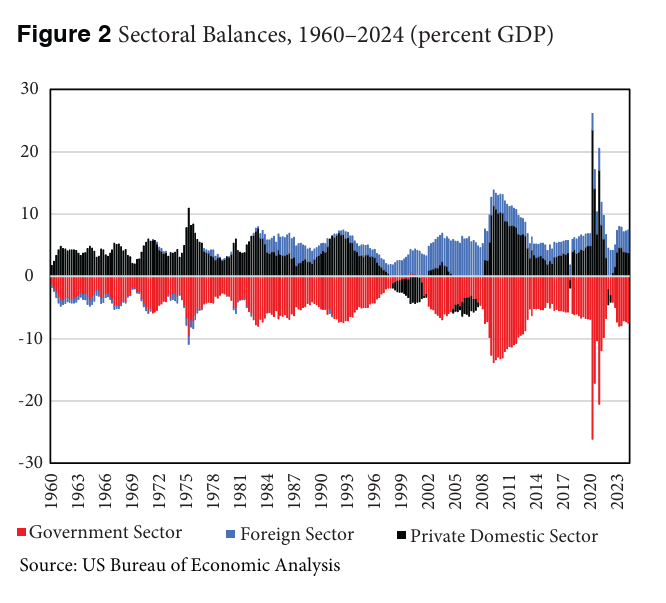

Figure 2 is based on the fundamental national accounting identity: at the aggregate level, spending must equal income (every dollar spent goes somewhere). It is useful to divide the economy into three sectors: domestic private (households, firms, and not-for-profits), domestic government (all levels, but movements of the government balance are dominated by the federal government), and foreign. Any sector can run a balanced budget (spending equals income), a surplus (spending is less than income), or a deficit (spending exceeds income). As the graph shows, the typical case for the US since the time of the Reagan administration is a private surplus, a government deficit, and a foreign surplus (the rest of the world runs a surplus against the US, largely because our imports exceed our exports).

Except for the Clinton years, the government sector runs a deficit that shrinks during economic expansions, and grows in recessions (again, the swings are mostly due to the federal budget—swings of state and local governments are more limited as they try to balance budgets). The pandemic is something of an exception—although the recession was deep, it was short-lived, as fiscal relief led to swift recovery and a postwar record deficit, which then shrank quickly due to the recovery of tax revenues as fiscal relief boosted growth.

The takeaway from the study of the sectoral balances is that swings of the federal budget are largely the result of countercyclical forces and help to balance/stabilize the economy. When private sector spending falls (in part because of rising unemployment), tax revenues fall sharply and government spending rises (largely because social transfer payments increase). This explains, in part, why recessions in the postwar period do not degenerate into depressions—as they did seven times in US history before WWII.

Note that as the foreign sector surplus tends to rise over time, the government deficit also tends to increase. This is not a coincidence—holding the private sector surplus stable, the government’s deficit must increase with the foreign sector surplus! Note also that if we believe that both the domestic private sector and the foreign sector have some discretion over their balances, then to that extent, the government sector does not have discretion. To put it simply, if US households decide to reduce spending and increase saving then the government’s deficit will rise (holding imports and exports constant). Why is that? Because less domestic spending reduces GDP and lowers tax revenues; as spending declines, unemployment goes up and government transfers increase. Voilà—the deficit increases.

Of course, the foreign balance does not have to remain constant, but trade policy has limited ability to increase US exports while reducing imports. Candidate Trump proposes large increases in tariffs, which could reduce imports, but as foreign nations can retaliate, it might also reduce US exports (and he already tried it once without much success). Over the past four decades, the general trend has been for larger foreign surpluses and it is not clear that US trade policy will have a large impact on that.

With regard to fiscal policy, we conclude that the federal budget outcome is largely a function of economic variables outside the control of Congress. Cutting important spending programs like Social Security could increase insecurity, encouraging households to try to save more—which would slow growth and put more pressure on the government’s budget. Tax hikes that hit a broad swath of consumers—which is what Leonhardt recommends—might have a similar effect. Tax hikes on the rich probably would not significantly affect their consumption, although Leonhardt seems to reject such a policy presumably because it would not raise as much revenue.

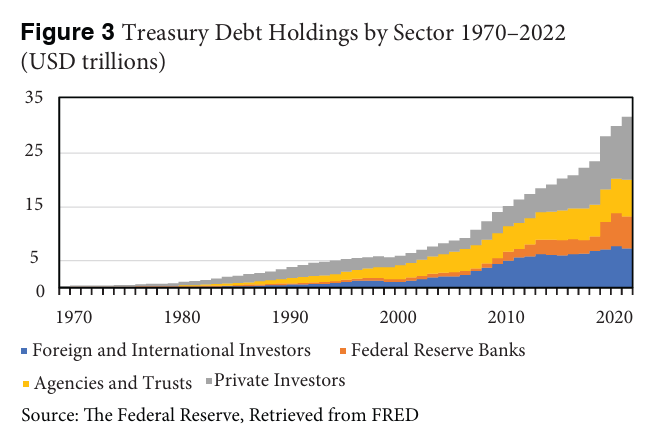

On the other hand, reducing government spending on interest would lower government spending, much of which we see as inefficient in terms of promoting economic growth. Interest income goes to foreigners, institutions, and higher-income individuals. Figure 3 provides a breakdown by type of recipient. Foreigners hold about a quarter of the debt—paying them interest might increase US exports, but that is probably fairly insignificant. The Fed and trusts and agencies (such as Social Security) hold somewhere less than half—this amounts to little more than internal record-keeping by the government, with the Treasury paying interest to other branches of government. Individual investors have the rest—more than a third. While we need to pay interest to foreigners and private investors to get them to lock up dollar savings in bonds, we can choose a much lower reward because these assets have no default risk.

They do, however, have capital risk; when the Fed raises its interest rate target, outstanding bonds fall in value. Fear of rate hikes can diminish the demand for longer maturity bonds. And when the Fed does raise rates, the new bonds issued promise higher returns—adding to government spending and the deficit. That is exactly what has happened over the past couple of years when the Fed raised rates.

Why does the Fed raise rates? By the early 1980s, monetarist thinking had become dominant at the Fed. It insists that inflation is caused by excess money supply, following Milton Friedman’s mantra that “inflation is always and everywhere a monetary phenomenon.” Over the 1980s and early 1990s, however, the empirical evidence strongly indicated that inflation did not correlate with the money supply—no matter how it was measured. The Fed abandoned monetary targets, and by 1994 began to announce its interest rate target (focused on the fed funds rate as the main tool of monetary policy).

Over the following three decades, the Fed used a wide variety of arguments as it tried to explain how its monetary policy works. Even researchers within the Fed itself argue that its policy is rudderless (Tarullo 2017). The Levy Institute has issued a series of papers over the past 30 years on the theme that “the Fed is flying blind” because it has not been able to articulate a plausible transmission mechanism through which higher interest rates affect inflation, nor why monetary policy provides the right tools for tackling inflation, nor even why current measures of inflation (such as the CPI or PCE) are appropriate for the purposes of formulating monetary policy.[ii]

The only thing we know for certain is that the Fed raises rates when robust growth reduces the unemployment rate. Since rapid growth reduces the budget deficit, the rate hikes also coincide with deficit reduction. The combination of a falling deficit (tighter fiscal policy) and a rate hike (tighter monetary policy) normally precipitates a recession. The recession plus higher interest rates boost the budget deficit. Following the recent round of rate hikes, we have not (yet) seen a recession—but the deficit has increased due to interest payments.

As we have discussed, higher interest rates cause problems in financial markets (for example, capital losses on existing assets), increase inequality (boosting income of the already rich), and increase business costs (interest is a major cost). Higher US interest rates tend to increase the global demand for dollar assets—leading to appreciation of the dollar (which can hurt exports and promote imports) and retaliatory action by foreign central banks that raise their interest rates to preserve the exchange value of their currency. Tight monetary policy spreads around the world, slowing global growth.

Candidate Trump has promised to curtail the Fed’s ability to hike interest rates if he is elected. This proposal has met nearly universal condemnation as an attack on the Fed’s supposed independence, viewed as a nearly sacred right. While we would not advocate putting interest rate setting in the hands of the president, we note that the Fed is a “creature of Congress”—and as Chairman Bernanke told Congress, if they do not like what the Fed is doing, they can change the Federal Reserve Act. We also note that during WWII, the Fed was essentially put under the control of the Treasury—which mandated both short-term and long-term interest rate targets. The purpose was to keep rates on government bonds low to reduce interest costs as government spending was ramped up to 50 percent of GDP as the country faced the challenge of war.

Fiscal policy was in the driver’s seat and monetary policy accommodated fiscal needs. Indeed, even control of inflation was delegated to fiscal policy as the government used a combination of taxes, rationing, wage and price controls, patriotic saving, and postponed consumption to successfully keep inflation in check. Unfortunately, all that changed during the 1970s as monetarism took hold and the Fed was gradually put in charge of inflation-fighting. As James Galbraith recently explained, that role was enshrined in the Humphrey-Hawkins Act of 1979 that imposed the “dual mandate” charging the Fed with the responsibility of maintaining full employment and price stability.

But the Fed has only one tool—its interest rate target. This is widely recognized to be a “blunt tool”—at best—that cannot be targeted to any specific causes of unemployment or inflation. And, indeed, the conventional view has long been that inflation can be fought by causing unemployment, creating an obvious problem for the dual mandate. When inflation picked up during the COVID pandemic, it was up to the Fed to use its single tool to fight inflation that was largely generated by supply shortages. It was never made clear why higher interest rates would resolve the problem of broken supply chains, housing shortages, and energy and wheat market disruptions caused by the war in Ukraine.

Instead, pundits—like Larry Summers—proclaimed that unemployment would have to rise, perhaps as high as 10 percent, to bring inflation down.[iii] In other words, rather than tackling the sources of the inflation problems, the prescription was to cause an extremely deep and destructive recession. Thankfully, the pundits turned out to be quite wrong—production gradually recovered and inflation fell while employment actually increased. The Fed was glad to take the credit, claim victory over the inflation beast, and begin to loosen policy. With its reputation as inflation-fighter boosted, it stood ready for the next challenge.

And that challenge appears to be … climate change–induced hurricanes, as reported in the New York Times on October 10:

The Fed is on high alert this hurricane season. Raphael Bostic, the Atlanta Fed president, said the one-two punch packed by Milton and Helene could affect the economy for at least six months, particularly by snarling supply chains. (Sorkin et al. 2024)

Precisely what the Fed is supposed to do is left to the imagination, but one supposes that it might again raise interest rates to tackle those snarling supply chains. Remember, the Fed only has one blunt tool with which to deal with the aftermath of those hurricanes.

Aside from the unsupported belief that the Fed can control inflation (no matter its source), adoption of transparency as well as gradualism in its policy-making means that its every move and utterance are subjects of endless anticipation and analysis. Since 1994, the Fed publicly announces its interest rate targets and engages in a long series of very small changes to its target to implement policy. This allows for continuous speculation throughout financial markets—during the run-up to each of its nearly monthly meetings the bets are placed, with winners and losers determined immediately after the announcements. When the Fed embarks on a campaign to raise rates—as it did over the past couple of years—it forces trillions of dollars of losses on holders of long-term bonds, including treasuries and mortgage-backed securities. In the latest episode of tightening, this pushed many banks into technical insolvency, and some of them into failure and resolution. As James Galbraith (2023) argues, “the policy of a sustained increase in short-term interest rates was—and is— inherently a vector of financial crisis.”

All of this is viewed as collateral damage, justified in the name of inflation-fighting with a blunt tool.

By contrast, fiscal policy—broadly defined—has a range of tools, some of which can be carefully targeted. The usual prescription in the case of inflation is to reduce government spending or raise taxes to reduce aggregate demand. This makes sense if the cause of inflation is excessive demand. But outside of WWII this has probably never been a problem, nor is it really possible to cut aggregate demand across the board. Spending cuts as well as tax increases are necessarily targeted. The usual case in the US is that inflation as measured by a price index is driven by a few categories—usually oil, food, and shelter—and occurs with significant unemployment of labor. Indeed, except for the COVID inflation, our high inflation occurred during periods of stagflation. Rather than hitting the entire economy with a hammer, it makes more sense to target efforts at controlling inflation pressure. And fiscal policy is more suited to a targeted response.

Leonhardt recognizes that the US faces major challenges—the moral equivalent of war (to borrow a phrase from the Carter administration as it faced stagflation). While tackling these will not require 50 percent of GDP, they will require a significant increase of federal spending.[iv] There is no way to know how much these might increase the budget deficit and the outstanding quantity of debt, but it is likely that budget deficits will be the norm—as they always are—and that the debt ratio will continue its slow climb (with larger increases in times of recessions).

The problem is not the deficit or the debt, but what the government spends on. The higher the Fed’s interest rate target, the more additional spending is devoted to servicing the debt—spending, that as we have explained, is not efficient in terms of meeting our policy goals.

It makes more sense to use tools that can target the sources of potential inflation. President Biden’s American Rescue Plan was a step in the right direction—as it included spending to boost capacity to avoid bottlenecks that would create price pressures. Government can also use targeted taxes to release resources for alternative use (for example, taxing fossil fuels to release resources for alternative energy), and subsidies to boost production where needed (for example, to increase the supply of low-income rental apartments). Lessons from the WWII experience can be used, if necessary, to prevent excessive demand during the transition to an environmentally sustainable economy: a temporary, broad-based income tax surcharge (with exemptions for low to moderate income), postponed consumption, and patriotic saving.

Reining in the Fed makes sense; cutting important social programs does not.

While there are real world wolves—Leonhardt mentions climate catastrophe and autocratic leaders, and we would add rising inequality and the concentration of economic and political power in the hands of billionaires—the federal debt is not one of them.

FOOTNOTES

[i] The military may make cash payments using Federal Reserve notes in foreign operations.

[ii] See Wray (2000; 2004), Nersisyan and Wray (2022a, b), Papadimitriou and Wray (1994a, b; 2021), and Fullwiler and Wray (2011).

[iii] He recommended one year at 10 percent or five years at 6 percent (Mellor 2021).

[iv] See Nersisyan and Wray (2021). They argue that a comprehensive Green New Deal will require about 5% of GDP each year for a decade; adding other programs to deal with other challenges could require several more percent of GDP.

REFERENCES

Fullwiler, S. and L. R. Wray. 2011. “It’s Time to Rein in the Fed.” Levy Economics Institute, Public Policy Brief No. 117. https://www.levyinstitute.org/publications/?docid=1371.

Galbraith, J. K. 2023. “In Defense of Low Interest Rates.” Levy Economics Institute, Policy Note 2023/3. https://www.levyinstitute.org/pubs/pn_23-3.pdf.

Leonhardt, D. 2024. “Federal Debt and the Election.” The New York Times, October 8, 2024. https://www.nytimes.com/2024/10/08/briefing/federal-debt-election-harris-trump.html.

Mellor, S. 2022. “5 years at 6% unemployment or 1 year at 10%: That’s what Larry Summers says we’ll need to defeat inflation.” Fortune, June 21, 2022. https://fortune.com/2022/06/21/larry-summers-calls-for-high-unemployment-to-curb-inflation.

Nersisyan, Y. and L. R. Wray. 2021. “Can We Afford the Green New Deal?” Journal of Post Keynesian Economics 44(1): 68–88.

Nersisyan, Y. and L. R. Wray. 2022a. “Is It Time for Rate Hikes?: The Fed Cannot Engineer a Soft Landing but Risks Stagflation by Trying.” Levy Economics Institute, Public Policy Brief No. 157. https://www.levyinstitute.org/publications/is-it-time-for-rate-hikes-the-fed-cannot-engineer-a-soft-landing-but-risks-stagflation-by-trying.

Nersisyan, Y. and L. R. Wray. 2022b. “What’s Causing Accelerating Inflation?: Pandemic or Policy Response?” Levy Economics Institute, Working Paper No. 1003. https://www.levyinstitute.org/publications/whats-causing-accelerating-inflation-pandemic-or-policy-response.

Papadimitriou, D. B. and L. R. Wray. 1994a. “Flying Blind: The Federal Reserve’s Experiment with Unobservables.” Levy Economics Institute, Working Paper No. 124. https://www.levyinstitute.org/publications/flying-blind.

Papadimitriou, D. B. and L. R. Wray. 1994b. “Monetary Policy Uncovered Flying Blind: The Federal Reserve’s Experiment with Unobservables.” Levy Economics Institute, Public Policy Brief No. 15. https://www.levyinstitute.org/publications/monetary-policy-uncovered.

Papadimitriou, D. B. and L. R. Wray. 2021. “Still Flying Blind after All These Years: The Federal Reserve’s Continuing Experiments with Unobservables.” Levy Economics Institute, Public Policy Brief No. 156. https://www.levyinstitute.org/publications/still-flying-blind-after-all-these-years-the-federal-reserves-continuing-experiments-with-unobservables.

Rudd, J. B. 2022. “Why do we think that inflation expectations matter for inflation? (And should we?)” Review of Keynesian Economics 10(1): 25–45.

Sorkin, A. R., R. Mattu, B. Warner, S. Kessler, M. J. de la Merced, L. Hirsch, and E. Livni. 2024. “Hurricane Milton and the Economy.” The New York Times, October 10, 2024. https://www.nytimes.com/2024/10/10/business/dealbook/milton-cpi-inflation-economy.html.

Tarullo, D. K. 2017. “Monetary Policy Without a Working Theory of Inflation.” Hutchins Center Working Paper No. 33.

Tymoigne, E. 2019. “Debunking the Public Debt and Deficit Rhetoric.” Challenge 62 (5): 281–98.

Wray, L. R. 2000. “Why Does the Fed Want Slower Growth?” “It’s Time to Rein In the Fed.” Levy Economics Institute, Policy Note 2000/7. https://www.levyinstitute.org/publications/why-does-the-fed-want-slower-growth.

Wray, L. R. 2004. “The Fed and the New Monetary Consensus: The Case for Rate Hikes, Part Two.” Levy Economics Institute, Public Policy Brief No. 80. https://www.levyinstitute.org/publications/the-fed-and-the-new-monetary-consensus.

Policy Note 2024/1(368.08 KB)